T Mobile Savings Account

Posted By admin On 10/04/22return to footnote reference1Savings-account interest is compounded and credited monthly, based on the daily collected balance. Interest rates are variable and determined daily at Chase's discretion and are subject to change without notice. Balance tiers are applicable as of the effective date of these rates and may change at Chase's discretion. Account fees could reduce earnings. CD interest is fixed for the duration of the term and is compounded daily.

- T-mobile Money Open Account

- T Mobile High Interest Savings Account

- T-mobile Savings Account

- T Mobile Savings Account Review

return to footnote reference2For Chase Premier SavingsSM: Earn Premier relationship rates when you link the account to a Chase Premier Plus CheckingSM or Chase SapphireSM Checking account, and make at least five customer-initiated transactions in a monthly statement period using your linked checking account. See interest rates.

Glassdoor is your resource for information about the Health Savings Account (HSA) benefits at T-Mobile. Learn about T-Mobile Health Savings Account (HSA), including a description from the employer, and comments and ratings provided anonymously by current and former T-Mobile employees.

T-mobile Money Open Account

Savings Text Message Program: Message and data rates may apply. For Help call 1-800-935-9935. Reply STOP to 33172 to no longer receive Chase Savings text messages until you provide your consent again. Mobile carriers not liable for delayed or undelivered messages.

- Accounts & Coverage Accounts & Services 6743 Network & Coverage 1835 T-Mobile for Business 69 TV & Home Internet 247 Devices Android 3551 Apple 855 SyncUP and IoT 361 Other Devices 996 Just for Fun Blog & Updates 164 Magenta Lounge 426.

- The bottom line is that the T-Mobile MONEY checking account is the great option if you’re a T-Mobile customer looking to earn a much higher interest rate on your checking. This account is also.

- Stay connected for less with a T-mobile promo code Right now there are so many T-Mobile promo codes happening with big savings on accessories and cell phone plans. Stay connected with high speeds and low prices. Some of the best deals that have recently come out include: 1. Save nearly $200 on select Apple products if you join a certain T.

IMPORTANT INFORMATION

T Mobile High Interest Savings Account

T-mobile Savings Account

The content of this page is informational only. Accounts are subject to approval. The terms of the accounts, including any fees or features, may change. See the Deposit Account Agreement and Additional Banking Services and Fees for the terms and conditions associated with these products.

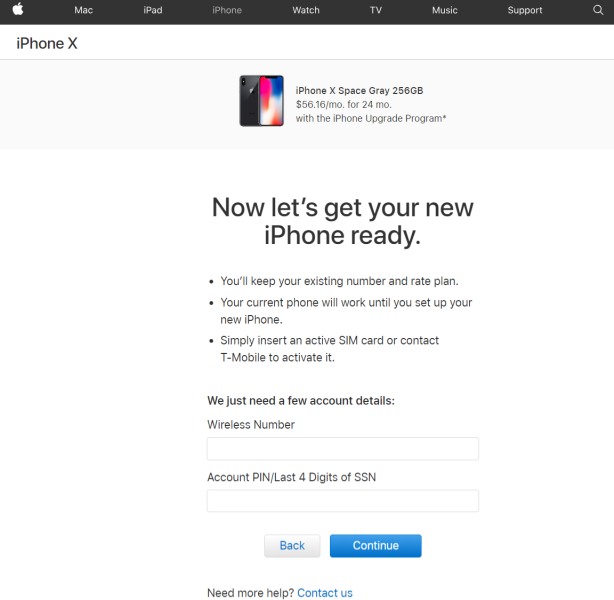

*How APY works: As a T-Mobile MONEY customer you earn 4.00% annual percentage yield (APY) on balances up to and including $3,000 in your Checking Account per month when: 1) you are enrolled in a qualifying T-Mobile postpaid wireless plan; 2) you have registered for perks with your T-Mobile ID; and 3) As of today: at least $200 in qualifying deposits have posted to your Checking Account before the last business day of the month. Deposits posting on or after the last business day of the month count toward the next month’s qualifying deposits. Promotional deposits are not eligible toward the $200 in deposits. If you meet this deposit requirement in a given month we will pay you this benefit in the subsequent month as an added value provided all other requirements are met. This added value is subject to change. Balances above $3,000 in the Checking Account earn 1.00% APY. The APY for this tier will range from 4.00% to 2.79% depending on the balance in the account (calculation based on a $5,000 average daily balance). Customers who do not qualify for the 4.00% APY will earn 1.00% APY on all Checking Account balances for any month(s) in which they do not meet the requirements listed above. APYs are accurate as of 3/1/2021, but may change at any time at our discretion. Fees may reduce earnings. For more information, see Account Disclosures / Terms and Conditions or go to our FAQs. PLEASE NOTE - Requirement #3 above will be changing. On March 31st, 2021, instead of the current qualifying deposit requirements, we will require that at least 10 qualifying purchases using your T-Mobile MONEY card have posted to your Checking Account before the last business day of the month. Qualifying purchases posting on or after the last business day of the month count toward the next month’s qualifying purchases. If you meet this purchase requirement in a given month, we will pay you this benefit in the subsequent month as an added value provided all other requirements are met.

T Mobile Savings Account Review

Get paid up to 2 days early with direct deposit: Subject to description and timing of the employer payroll-based direct deposit, we typically make funds available the business day received, which may be up to 2 days earlier than scheduled.