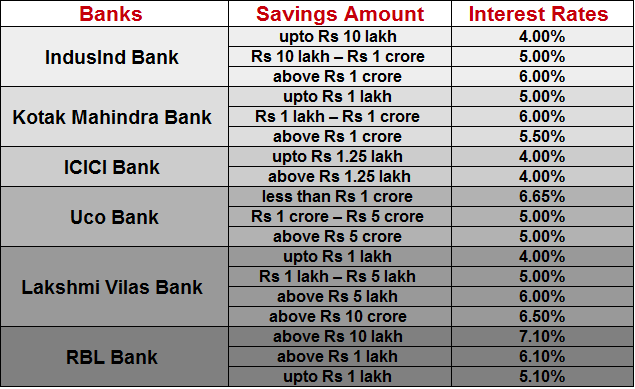

Uco Bank Savings Account Interest Rate

Posted By admin On 26/03/22Which bank gives highest PPF account interest rates? The Public Provident Fund (PPF) is a savings-cum-tax-saving scheme is introduced by National Saving Institute of the Ministry of Finance and it's not a product of any particular bank, so PPF interest rate will same for all the banks as well as post offices. History Of UCO Bank; Performance Highlights; India Operations. Loans/Advances; Deposits; Value Added Services. Savings Bank Account Current Account Fixed Deposits. CURRENCY: MINIMUM BALANCE: Individual: 1: SINGAPORE DOLLAR(SGD) 200 Savings Bank Interest Rate is 0.1%. Current Account.

- What Is The Interest Rate Of Uco Bank

- How Much Interest In Uco Bank

- Uco Bank Savings Account Interest Rate Singapore

- Uco Bank Savings Account Interest Rates

Non-maintenance of Minimum balance – Quarterly (Saving Account) 25.00: 200.00: Inoperative/ Dormant Account Charge - half yearly - (Current Account) 100.00: 800.00: Inoperative/ Dormant Account Charge - half yearly - (Savings Account) 50: 400.00: Instruction for change of Authorized Signatory: 50.00: 300.00: Account Closure (within 12 months.

Table of Contents

- 4 UCO Bank Fixed Deposit Schemes

- 5 UCO Bank Fixed Deposit Interest Calculator

- 5.3 Features of UCO Bank Double Deposit Scheme

About UCO Bank Fixed Deposit

A fixed deposit is key to bring a smile on your face as it paves way for the creation of wealth that helps you realize your dreams, which get bigger with time. Every dream needs financing, which can come from fixed deposits that convert a deposited amount into a large corpus over time. When it comes to parking your fund, you can look upon UCO Bank, a Kolkata-headquartered public sector bank that services its customers through more than 4,000 units, close to 50 zonal offices spread across India. The fixed deposit schemes of the bank are suitably designed to meet the specific requirements of the customers. You all would be keen to know the FD interest rates offered by the bank on specific deposit amounts.

UCO Bank FD Interest Rates March 2021

Domestic Deposits

| Time Period | Interest Rate on Deposit <2 Cr (w.e.f. 05.12.2019) | Interest Rate on Deposit of ₹ 1 Cr. - 5 Cr. (w.e.f. 05.12.2019) |

|---|---|---|

| 7-14 Days | 4.50% | 4.00% |

| 15-29 Days | 4.50% | 4.00% |

| 30-45 Days | 4.50% | 4.00% |

| 46-60 Days | 5.00% | 4.00% |

| 61-90 Days | 5.00% | 4.00% |

| 91-120 Days | 5.00% | 4.25% |

| 121-150 Days | 5.00% | 4.25% |

| 151-210 Days | 5.00% | 4.25% |

| 211-270 Days | 5.90% | 4.75% |

| 1 Year | 6.20% | 4.75% |

| 1-2 Years | 6.20% | 4.75% |

| 2-3 Years | 6.20% | 4.75% |

| 3-5 Years | 6.15% | 5.00% |

| 5 Years & Above | 6.15% | 5.00% |

How to Open UCO Bank Fixed Deposit?

Visit any nearest UCO Bank branch and request for application form with respect to fixed deposit. After you receive the form, make sure you fill in the necessary details and submit it to the bank desk for the processing of your application. Along with the application form, you need to deposit a cheque bearing an amount of your wish. The bank officials will verify your identity and address proof details and open your fixed deposit account after successful verification.

UCO Bank Fixed Deposit Schemes

Get ready to taste the slice of various fixed deposit schemes at UCO Bank. The schemes include Kuber Yojana, UCO Monthly Income Scheme, UCO Tax Saver Deposit Scheme-2006 and Flexible Deposit Scheme. These schemes will let interest to compound on a monthly or quarter basis, thereby raising your wealth substantially over the long-term. So, let’s start to discuss the schemes one-by-one.

Kuber Yojana

This is a long-term deposit scheme where interest is compounded quarterly in the wake of reinvestment, thus putting more into your wallet at the time of maturity. Check out below the features of the scheme.

Features

- Minimum Deposit Amount- ₹ 1,000

- Maximum Deposit Amount-No Limit

- Minimum Deposit Period-6 Months

- Maximum Deposit Period-10 Years

- Interest Compounded at Quarterly Intervals

- Total Interest Payable at Maturity

UCO Monthly Income Scheme

The scheme, which runs for a period of 5 years, let investors yield interest on a monthly basis. Salient features of the scheme are shown below.

Features

- Minimum Deposit Amount-₹50,000 and in multiples of ₹10,000 afterwards

- Maximum Deposit Amount- ₹1 Crore

- 1% Penalty on Interest Rate Chargeable on Premature Withdrawal

- Loan & overdraft facility available

- Nomination facility available

UCO Tax Saver Deposit Scheme

It is a term deposit scheme that has a maturity of up to 5 years. Like many tax saver deposit schemes, it also has a lock-in period of 5 years.

Features

- Minimum Deposit Amount-₹100

- Maximum Deposit Amount- ₹1.5 lacs Annually

- Minimum Period of Deposit-5 Years

- Tax Benefit Applicable for a Maximum Limit of Up to ₹1.5 Lacs Under Section 80C of the Income Tax Act

- Nomination Facility Available

- Scheme Transferable from Branch to Branch

Interest Rate on UCO Tax Saver Deposit Scheme

| Category | Interest Rate |

|---|---|

| General | 7.25% p.a. |

| Senior Citizen | 7.75% p.a. |

| Staff/Ex Staff/Ex Staff Senior Citizen | 7.75% p.a. |

Flexible Fixed Deposit Scheme

Looking for a scheme that will allow you premature withdrawal without bearing any penalty? UCO Bank Flexible Fixed Deposit Scheme is the one to go for. The reinvestment plan accepts the deposits and allows investors to prematurely withdraw a part of the deposit. While, the remaining amount continues to fetch interest at a normal rate. You can withdraw the sum in the multiples of ₹5,000.

These were the details of UCO Bank fixed deposit schemes. However, there was a popular scheme titled ‘UCO Bank Double Fixed Deposit Scheme’, which has now got closed. If you happen to have booked that particular scheme, then you must be getting anxious to know the minute details of the same. We can help you in that by showcasing the features of the scheme.

UCO Bank Fixed Deposit Interest Calculator

The fixed deposit interest calculator takes into account the principal amount, rate of interest and compounding of interest, be it on a monthly, quarterly, half-yearly or annual intervals, to compute the overall sum including interest. So, if you know the interest rate and compounding intervals, you can easily calculate your earning on the deposit amount.

What Is The Interest Rate Of Uco Bank

Eligibility Criteria

- Individuals

- Hindu Undivided family

- Jointly by two adults or jointly by an adult and a minor, and payable to either of the holders or to the survivor

- Joint Stock Companies

- Executors & Administrators in their names

- Clubs

- Societies

- Associations

- Educational Institutions

- Trusts

- Sole Proprietory Concern

- Partnership Firms

Documents Required

- Fixed Deposit Account Opening Form

- Cheque

- 2-3 Passport Size Photographs

- Identity Proof- Passport, PAN Card, Driving License, Voter ID, Aadhaar Card, Photo Ration Card, Senior Citizen ID Card

- Address Proof- Passport, Electricity Bill, Telephone Bill, Bank Statement, Certificate or ID Card Issued by Post Office

Features of UCO Bank Double Deposit Scheme

- Minimum Deposit Amount-₹5,000

- Maximum Deposit Amount-₹ 1 Crore

- Interest Payable on Quarterly Basis with the Power of Compounding

- Premature Withdrawal Charged at 1% Below the Applicable Rate from the Date of Deposit to the Withdrawal Date

- Loan & Overdraft Facility Available

- Nomination Facility Available

- Tax Deduction as per Income Tax Act

- Deposits Not Transferable

Savings Accounts

- Available in HKD & USD

- With Cheque book facility

- Attractive Interest rates (payable monthly)

How Much Interest In Uco Bank

Documents required for opening Accounts:

Uco Bank Savings Account Interest Rate Singapore

- Completed Account Opening Form

- Photocopy of Passport

- Photocopy of Identification Documents

- Latest passport size photograph

- Photocopy of address proof

Uco Bank Savings Account Interest Rates

RETAIL DEPARTMENT

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||