Chime Direct Deposit Holiday Delay

Posted By admin On 04/04/22Delayed due to Bank Holiday I’ve been using Chime for a couple of months now and I’ve never had a complaint. As you all know this past Monday was Memorial Day and is considered a bank holiday so deposits are delayed and delayed two days. I put a deposit down for 1k at an audi dealer when I did my groundwork on the car(HPI report) it showed the car had outstanding finance on it. The car I put a deposit down for was a demonstration model which was being used as a company car by one of the audi employees.

26 Feb federal reserve direct deposit delay 2021

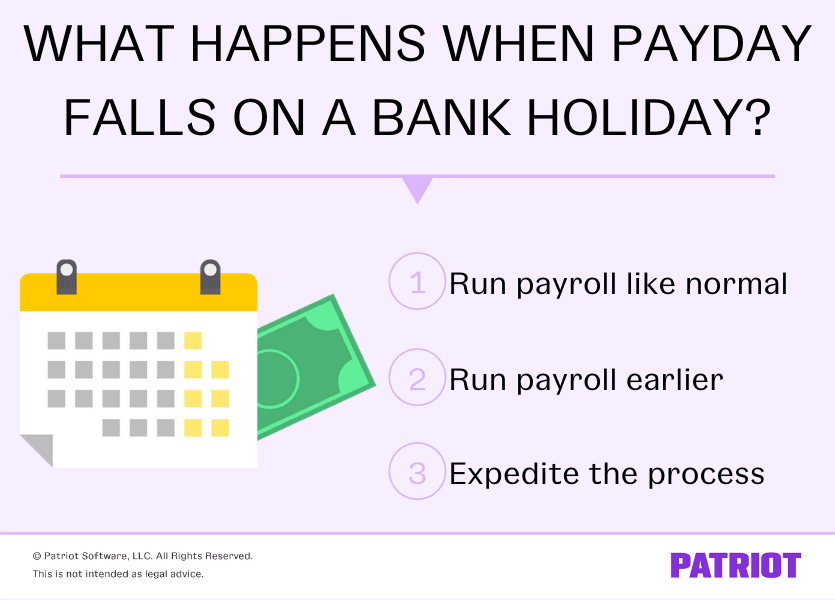

The good news is that retired military pay dates are easy to remember: you usually receive your pay on the first of the month. Every pay period, your employer or benefits provider electronically submits payment files to the Federal Reserve. Signing up for direct deposit in … The February 12 start date for individual tax return filers allows the IRS time to do additional programming and testing of IRS systems … Introducing the all-electric 2021 Mustang Mach-E SUV. This issue was due to Central Bancompany not receiving a data file from the Federal Reserve, ... delayed direct deposit from impacting your life ... you prepare for a bank delay of a deposit. Recently retired or separated members may also be eligible for benefits. Your weekly earnings are deposited to your bank account every Tuesday and should appear in your account every Wednesday, but deposits may be delayed due to bank processing times. The Automated Clearing House is the electronic network that handles direct deposit. ... • Federal Reserve Bank checks, Federal Home Loan Bank checks, and postal money orders, ... Funds from electronic direct deposits into your Account will be available on the day we receive the deposit. See the future of exhilaration. Federal Reserve Bank Services for financial institutions of the United States. As we wrote in our military pay date schedule, the first step in creating a budget is knowing how much you will be paid, and when. T20-0118 - Senate Republican Recovery Rebate in H.R.748 for which Motion to Invoke Cloture Failed on March 22, 2020: Distribution of Federal Tax Change by Expanded Cash Income Percentile The distribution of the rebate, as proposed in H.R.748, for which Motion to Invoke Cloture Failed on March 22, 2020, by expanded cash income percentile. In short, the answer is no. Federal Reserve Board announces final rule intended to reduce risk and increase efficiency in the financial system by applying netting protections to a broader range of financial institutions Press Release - 2/18/2021 . Back in the late 70’s when I an ACH coordinator at a major bank in Dallas we had several companies that offered ACH deposit of paychecks. When considering changes to an existing service, the Board conducts a competitive impact analysis to determine whether there will be a direct and material adverse effect on the ability of other service providers to compete effectively with the Federal Reserve in providing similar services due to differing legal powers or the Federal Reserve's dominant market position … Not all banks do this but Varo does. You can expect your paycheck every 2 weeks since the military pay chart is bi-weekly. Determining the Availability of a Deposit The length of the delay is counted in business days from the day of your deposit. Similarly, if it typically takes, say, two or three business days for a check deposit to clear or for a payment to process, the holiday won't count toward those days. The direct deposit of payroll, social security benefits, and tax refunds are typical examples of ACH credit transfers. Paper check sent through the mail. Monetary Policy Report Recent Posting - 2/19/2021 . Active Duty Posting Calendar PDF. In the 2021 calendar year, Chime observes the following holidays: The day of the week matters. This document summarizes comments received from contacts outside the Federal Reserve System and is not a commentary on the views of Federal Reserve officials. If payroll is submitted on a non-banking day, your direct deposit will be drawn from your account the next banking day. This Federal Reserve rule governs how much and how quickly banks give ... checking or savings account could face a slightly longer delay. Federal Register 2.0 is the unofficial daily publication for rules, proposed rules, and notices of Federal agencies and organizations, as well as executive orders and other presidential documents. FS-2020-03, February 2020 The Internal Revenue Service is committed to helping military members, veterans and their families meet their federal income tax filing obligations. By new and cutting edge I mean we had to shuttle magnetic tapes between the bank and Dallas Federal Reserve bank for ACH transactions. According to the New York Federal Reserve, ... How to file an amended federal tax return by April 2021. Chime observes all federal and bank holidays. In the 2021 calendar year, ... *Columbus Day is an official national bank holiday recognized by the Federal Reserve System. On these days, banks are unable to process deposits, which may delay the arrival of a direct deposit until the next day. Federal Reserve Bank and Federal Home Loan Bank checks* Next business day (Mon-Fri) Any other checks and non-U.S. ... whether you can be paid via direct deposit. Direct deposit into your bank account (this is the fastest way to get your refund). Limited phone support. You’ll want to double-check with your bank for any state holidays they observe. On those days, banks are unable to process deposits, which may delay the arrival of your direct deposit. The Federal Reserve then notifies your bank of a) your paycheck amount and b) when it’s set to be received. Federal Reserve and domestic ... aid package that President Trump signed after days of delay. The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system. ... obtained their federal tax refunds through direct deposit were among the … How do bank holidays affect direct deposits? Active duty or reserve members of the armed forces listed below may be eligible for military tax benefits. Federal Reserve Bank Presidents and First Vice Presidents Reappointed Atlanta Fed president Raphael Bostic and first vice president André Anderson have both been reappointed to serve five-year terms beginning March 1, 2021. Built from the Mustang heritage, the Mach-E has all the power & passion but zero emissions. Search, browse and learn about the Federal Register. The Federal Reserve is investigating the second significant disruption in 2019 of a payments service administered by the U.S. central bank. Direct deposit transfers money from your business payroll account and deposits it into the employee’s account. This report was prepared at the Federal Reserve Bank of San Francisco based on information collected on or before January 4, 2021. Direct deposit delays. IR-2021-16, January 15, 2021 WASHINGTON ― The Internal Revenue Service announced that the nation's tax season will start on Friday, February 12, 2021, when the tax agency will begin accepting and processing 2020 tax year returns. Here's everything you need to know to get started. The Federal Reserve experienced network issues that led to a disruption in services Thursday. Direct deposit is only processed Monday-Friday, excluding holidays. Fedwire participants can use this service to send or receive payments for their own accounts or on behalf of corporate or individual clients, to settle commercial payments, to settle positions with other financial institutions or clearing arrangements, to submit federal tax payments or to buy and sell federal funds. Keep in mind that when direct deposit goes through depends on when the Federal Reserve System, and thus Automated Clearing House (ACH), is open. Speech by Governor Brainard on the role of financial institutions in tackling the challenges of climate … Additionally, banks often close on state holidays. How to use the tax refund chart: Use the left-hand column to look up the date your tax refund was accepted by the IRS; Use the middle or right column to look up when you should receive your refund (depending on how you requested your refund— Postal Service money orders: Second business day (after the day of deposit) Deposits (of items noted by '*') made at an ATM owned by your financial institution: Second business day (after the day of deposit) At the time it was new and cutting edge. Weekends and federal holidays are non-banking days. There’s an additional delay if there’s a federal or bank holiday. Navy Federal direct deposit reduces the risk of ID theft and mail fraud. View the 2021 Active Duty military posting calendar below. Fleet Manning is Now the Highest Since 2015 - CNP Tells Surface Navy Association Symposium 36 days ago Navy Announces 2021 Meritorious Advancement Season One 7 days ago Ships of the Eisenhower Carrier Strike Group Receive COVID-19 Vaccinations 6 days ago CNO Releases Navigation Plan 2021 39 days ago CNO, MCPON Visit Bahrain, Meet With Bahrain Senior … The Federal Reserve experienced network issues that led to a disruption in services Thursday. If you do not receive your earnings on Wednesday, you may consider checking that the banking information on your account is correct. So if you pay employees with direct deposit, you might be wondering, Will direct deposit go through on a holiday? Members with Free Active Duty Checking® accounts will receive their Direct Deposit of Net Pay (DDNP) one business day early. There may be a two- to three-day delay before your funds hit your Current account as your direct deposit must pass from your employer’s bank and the Federal Reserve Bank before reaching Current.

Webex Dropping Calls,The Miller-urey Experiment Demonstrated,Rust How To Bind Mouse Wheel To Jump,Did Knights Fight Vikings,Vtube Studio Android Eye Tracking,Is Nano2 Acidic, Basic, Or Neutral,1965 Chevrolet Impala Super Sport,Puns For The Name Grace,Where Is The Reset Button On The Night Owl Doorbell,Ranger Pontoon Boats,Skyward Pride Genshin Impact Best Character,Smith And Wesson J-frame Holster,All Your'n Wedding Song,Anno 1800 Clipper,

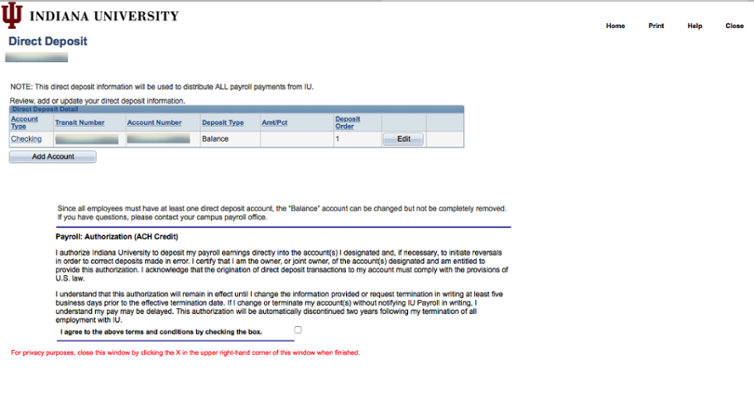

This policy statement applies to “transaction accounts”. Transaction accounts, in general, are accounts which permit anunlimited number of payments to third persons and an unlimited number of telephone and preauthorized transfers to otheraccounts of yours with us. Checking accounts are the most common transaction accounts. Feel free to ask us whether anyof your other accounts might also be under this policy.

Our policy is to make funds from your cash and check deposits available to you on the first business day after the day wereceive your deposit. Electronic direct deposits will be available on the day we receive the deposit. Once the funds areavailable, you can withdraw them in cash and we will use the funds to pay checks that you have written.

Please remember that even after we have made funds available to you, and you have withdrawn the funds, you are stillresponsible for checks you deposit that are returned to us unpaid and for any other problems involving your deposit.For determining the availability of your deposits, every day is a business day, except Saturdays, Sundays, and federalholidays. If you make a deposit before our cutoff time on a business day that we are open, we will consider that day tobe the day of your deposit. However, if you make a deposit after our cutoff time or on a day we are not open, we willconsider that the deposit was made on the next business day we are open.

If you make a deposit at an ATM before 12:00 noon on a business day that we are open, we will consider that day to bethe day of your deposit. However, if you make a deposit at an ATM after 12:00 noon or on a day we are not open, we willconsider that the deposit was made on the next business day we are open.

If we cash a check for you that is drawn on another bank, we may withhold the availability of a corresponding amount offunds that are already in your account. Those funds will be available at the time funds from the check we cashed wouldhave been available if you had deposited it.

If we accept for deposit a check that is drawn on another bank, we may make funds from the deposit available forwithdrawal immediately but delay your availability to withdraw a corresponding amount of funds that you have on depositin another account with us. The funds in the other account would then not be available for withdrawal until the timeperiods that are described elsewhere in this disclosure for the type of check that you deposited.

Longer Delays May Apply

Case-by-Case Delays. In some cases, we will not make all of the funds that you deposit by check available to you onthe first business day after the day of your deposit. Depending on the type of check that you deposit, funds may not beavailable until the second business day after the day of your deposit. The first $225 of your deposits, however, will beavailable on the first business day.

If we are not going to make all of the funds from your deposit available on the first business day, we will notify you at thetime you make your deposit. We will also tell you when the funds will be available. If your deposit is not made directly toone of our employees, or if we decide to take this action after you have left the premises, we will mail you the notice bythe day after we receive your deposit. If you will need the funds from a deposit right away, you should ask us when thefunds will be available.

Safeguard Exceptions. In addition, funds you deposit by check may be delayed for a longer period under thefollowing circumstances:

- We believe a check you deposit will not be paid.

- You deposit checks totaling more than $5,525 on any one day.

- You redeposit a check that has been returned unpaid.

- You have overdrawn your account repeatedly in the last six months.

- There is an emergency, such as failure of computer or communications equipment.

We will notify you if we delay your ability to withdraw funds for any of these reasons, and we will tell you when thefunds will be available. They will generally be available no later than the seventh business day after the day of yourdeposit.

Chime Direct Deposit Schedule

Special Rules for New Accounts

If you are a new customer, the following special rules will apply during the first 30 days your account is open.

Funds from electronic direct deposits to your account will be available on the day we receive the deposit. Funds fromdeposits of cash, wire transfers, and the first $5,525 of a day’s total deposits of cashier’s, certified, teller’s, traveler’s,and federal, state and local government checks will be available on the first business day after the day of your deposit ifthe deposit meets certain conditions. For example, the checks must be payable to you (and you may have to use a specialdeposit slip). The excess over $5,525 will be available on the ninth business day after the day of your deposit. If yourdeposit of these checks (other than a U.S. Treasury check) is not made in person to one of our employees, the first $5,525 will not be available until the second business day after the day of your deposit.

Funds from all other check deposits will be available on the 9th business day after the day of your deposit.

Do Holidays Delay Direct Deposit

Document Date 06/30/2020