Bank Of America Check Deposit Policy

Posted By admin On 25/03/22

If you bank at Bank of America, never make an ATM deposit there, especially if the money’s coming from another bank. Here’s why…

Bank Of America

Check your mobile device If you're enrolled in this security feature, we sent a notification to your registered device. Verify your identity in the app now to sign in to Online Banking. Send notification again Sign In with Passcode instead. Bank of America, N.A. Short Answer: Bank of America handles third-party checks on a case-by-case basis. To cash or deposit a third-party check, it must be endorsed by all parties, and both signing parties should be present at the branch’s Financial Center. This applies to both Bank of America customers and non-account holders.

I’m a Bank of America account-holder, which is to say I’ve also been a Bank of America hostage.

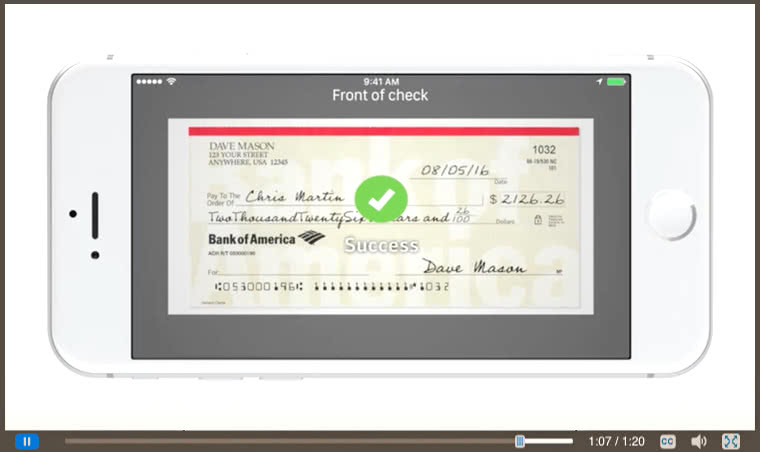

For the last week, Bank of America has held a $2,080 deposit of mine — written by my business partner off her account with another bank — as “delayed.” For a week. For seven days, Bank of America customer service agents either wouldn’t or couldn’t explain why I could not access money that was properly deposited and is MY money.

Until last night.

After I raised a stink on social media (which is a #WiseStrategy you should read about here), a very professional BofA social media agent reached out. She explained to me that because I deposited the check via an ATM inside my neighborhood Bank of America branch and because the check was an unusual amount ($2,080? Not exactly a fortune) written from another bank’s account, it triggered a 7-day delay in making the funds available.

Well, that triggered me — not only because my own bank was holding my money hostage, but also because my bank may have violated federal law.

According to BankRate.com, federal regulations require that local funds deposited via an ATM must be made available no later than the second business day after the deposit, as long as the check was deposited on a banking day (mine was a non-holiday Monday), and the check was deposited in an ATM owned by the depositor’s bank (it was). Non-local checks can be held for five business days, but not a day longer.

As if she were doing me a favor, the BofA social media agent proudly announced she would release my funds to me, even though BofA sent me a notice that it intended to delay the deposit as long as eightbusiness days — again, in violation of federal regulations according to BankRate.com.

Of course, I have neither the time nor the money to sue Bank of America. But I do have my blog and the bully pulpit of Wise Choices…and I will soon be taking my banking elsewhere.

Just so you know, here’s BankRate.com’s summary of federal regulations regarding the availability of deposited funds:

Bank Of America Check Deposit Rules

- Banks must post or provide a notice at each ATM location that funds deposited in the ATM may not be available for immediate withdrawal.

- If a bank makes funds from deposits at an ATM it doesn’t own available for withdrawal later than funds from deposits at an ATM it does own, it must provide a description of how the customer can tell the difference between the two ATMs.

- If you deposit money in an ATM that isn’t owned by your bank, the funds must be available for withdrawal not later than the fifth business day following the banking day on which the funds are deposited.

- Funds deposited at an ATM that is not on or within 50 feet of the premises of the bank are considered deposited on the day funds are removed from the ATM, if funds are not normally removed from the ATM more than two times each week.

- A bank that operates an off-premises ATM from which deposits are not removed more than two times each week must disclose at or on the ATM the days on which deposits made at the ATM will be considered received.

- Funds deposited at a staffed facility, ATM or contractual branch are considered deposited when they are received at the staffed facility, ATM or contractual branch.

Bank Of America Check Deposit Policy Login

Copyright 2018 Wise Choices TM. All rights reserved.